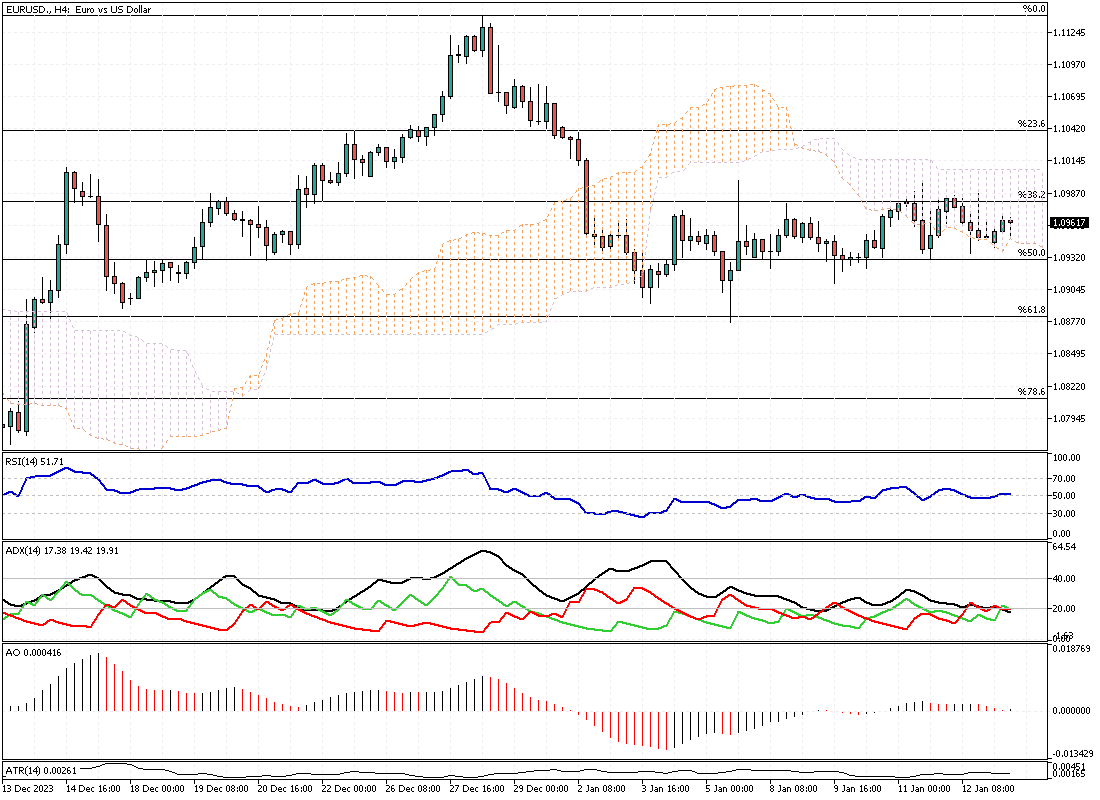

The EURUSD recently held strong, staying above $1.09. This stability results from investors analyzing comments from ECB (European Central Bank) officials. They’re also adjusting their views on the US Federal Reserve’s next steps, especially after a surprising US inflation report.

Earlier in the week, ECB President Christine Lagarde spoke optimistically. She believes the most challenging phase of inflation might be over. She underlined a crucial point: if inflation drops to 2%, interest rates will follow suit and decrease. Adding to this perspective, Vice President Guindos of the ECB brought up the chance of a minor recession later in 2023. He noted that the slowdown in inflation seen last year will likely take a brief pause in early 2024.

Similarly, the Bank of France’s Governor, Villeroy de Galhau, confirmed the ECB’s readiness to lower interest rates this year. That’s conditional, though – they’re waiting for signs that inflation aligns with their 2% target. This collection of insights from high-ranking ECB officials paints a picture of cautious optimism. They’re navigating the tricky waters of global economics with a keen eye on inflation and its impacts on the Euro and broader financial stability.