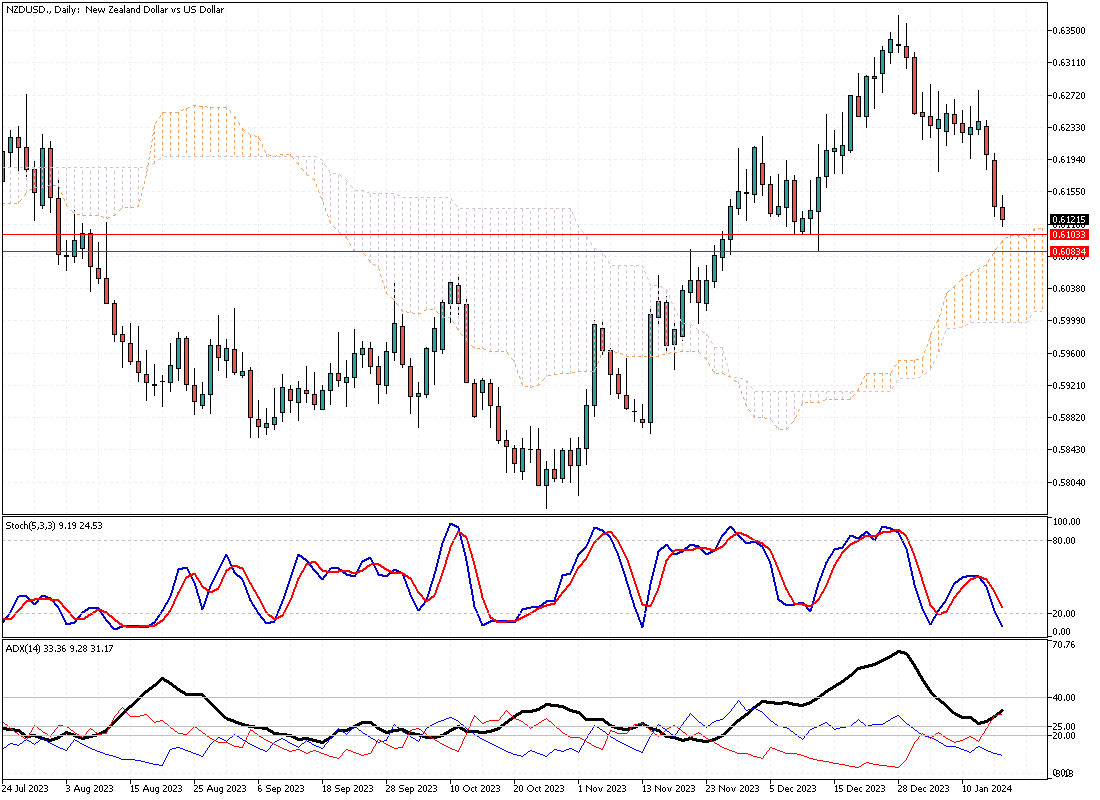

The NZDUSD currency pair recently experienced a notable decline, falling past the $0.615 mark, its weakest point in over a month. This downward movement in the currency’s value is primarily driven by the market’s growing belief that New Zealand’s interest rates have peaked. Market participants anticipate a potential monetary policy easing, with expectations of up to 100 basis points in rate reductions within the year.

Investors are also keenly awaiting a speech by Paul Conway, the Chief Economist of the Reserve Bank of New Zealand (RBNZ), scheduled for later in the month. It is widely speculated that Conway might challenge these dovish market expectations, providing insights into the central bank’s future monetary policy direction.

In a positive turn, recent data indicated a significant improvement in business confidence in New Zealand during the fourth quarter. There was a dramatic shift in sentiment, with only a net 2% of firms expecting business conditions to worsen, starkly contrasting the 52% who held a pessimistic view in the preceding quarter. This improvement in business confidence is a crucial indicator of the economic outlook, reflecting the optimism or pessimism of businesses towards the future state of the economy, which can influence their investment and employment decisions.

Externally, the New Zealand dollar, commonly called the Kiwi, faced additional pressure due to a resurgence in the value of the US dollar. This rebound was primarily caused by traders reassessing their expectations of early interest rate cuts by the US Federal Reserve.

The fluctuations in the New Zealand dollar and the anticipation of monetary policy shifts highlight the interconnectedness of global economies and the impact of central bank decisions on currency markets. The RBNZ’s actions and outlook, especially in response to changing economic conditions, play a pivotal role in shaping the value of the Kiwi. This, in turn, affects New Zealand’s international trade and the broader economy, underlining the significance of central bank policies and economic indicators in the global financial landscape.