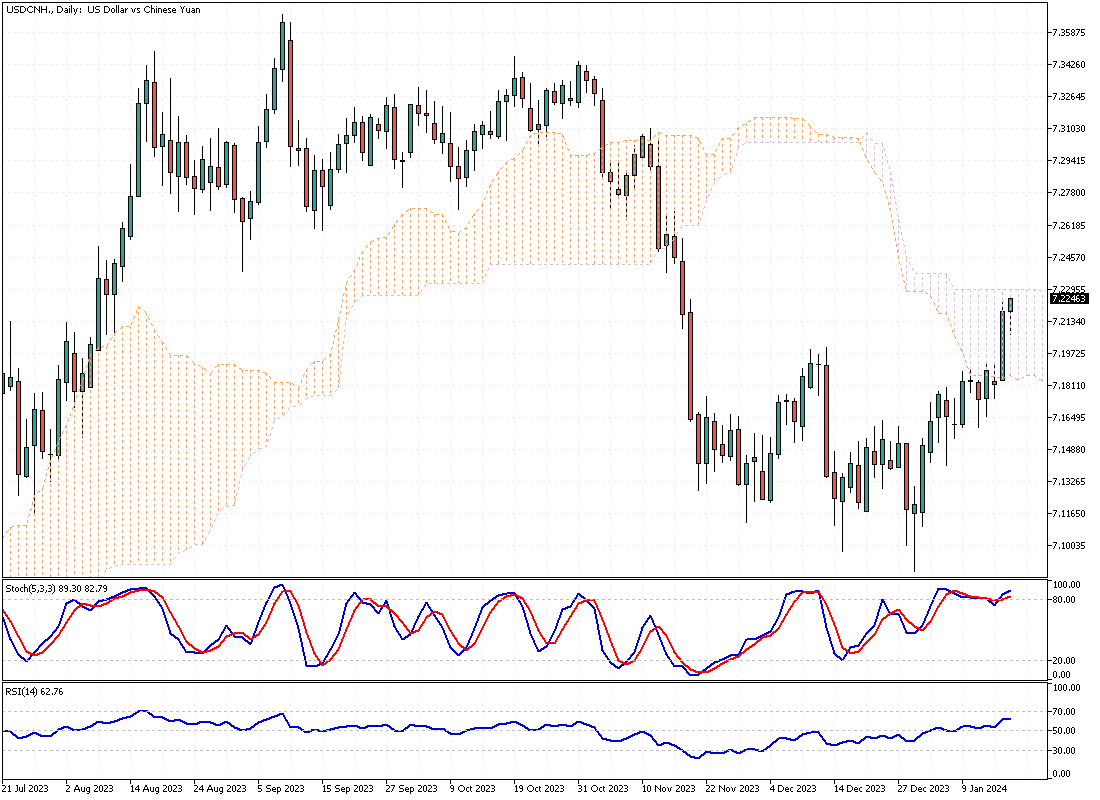

The offshore yuan recently experienced a noteworthy decline, crossing the 7.21 per dollar threshold. This movement marks its weakest level in almost two months, primarily driven by a strengthened US dollar following hawkish comments from a US Federal Reserve official. These comments have tempered expectations for an imminent interest rate cut in March.

Amidst these external factors, investors are also closely examining domestic economic indicators from China. Recent data revealed that China’s economy expanded by 5.2% year-on-year in the fourth quarter, slightly below the forecasted 5.3%. However, for 2023, China’s GDP growth reached 5.2%, surpassing the government’s target of 5%. This performance highlights the resilience and gradual recovery of the Chinese economy despite various global economic challenges.

On the retail front, December’s sales growth in China fell short of expectations, indicating ongoing consumer caution. In contrast, the country’s industrial production showed significant strength, registering the most substantial expansion in 22 months. This contrast between retail and industrial performance reflects China’s complex and multifaceted economic landscape.

Investors and market analysts are now speculating on the potential actions of the People’s Bank of China (PBoC). The recent depreciation of the yuan has cast uncertainty over whether the PBoC will further ease monetary policy soon. Despite this currency weakness, China’s prevailing deflationary environment and somewhat shaky economic recovery continue to support the case for reducing monetary policy.