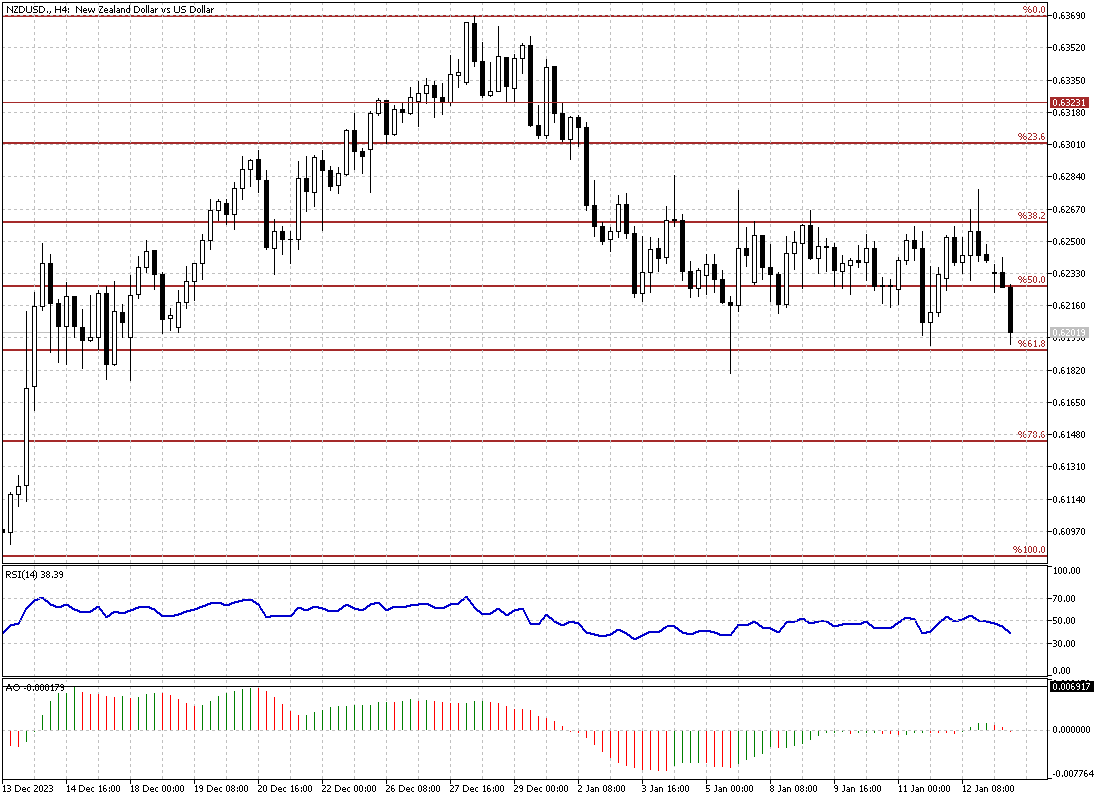

The NZDUSD pair has recently experienced a notable increase, reaching approximately $0.625. This rise comes after a period of significant fluctuation. One key reason for this change is the weakening of the US dollar. Investors widely expect the Federal Reserve to lower interest rates multiple times yearly. In the US, recent producer inflation figures were unexpectedly low for December. This development contrasts with the earlier higher-than-anticipated consumer inflation statistics. These contrasting data points have influenced market trends and expectations.

In New Zealand, financial markets are anticipating several interest rate reductions from the Reserve Bank of New Zealand (RBNZ). Analysts predict as many as four cuts this year, with the first possibly happening in May. The central bank’s head has recently recognized unexpected slowdowns in economic growth. This acknowledgment has led to increased speculation about a sooner-than-expected decrease in the cash rate.

Remember, the RBNZ had maintained the cash rate at 5.5% in November. They were on the verge of increasing it further. However, these recent developments and expectations suggest a shift in the direction of monetary policy.