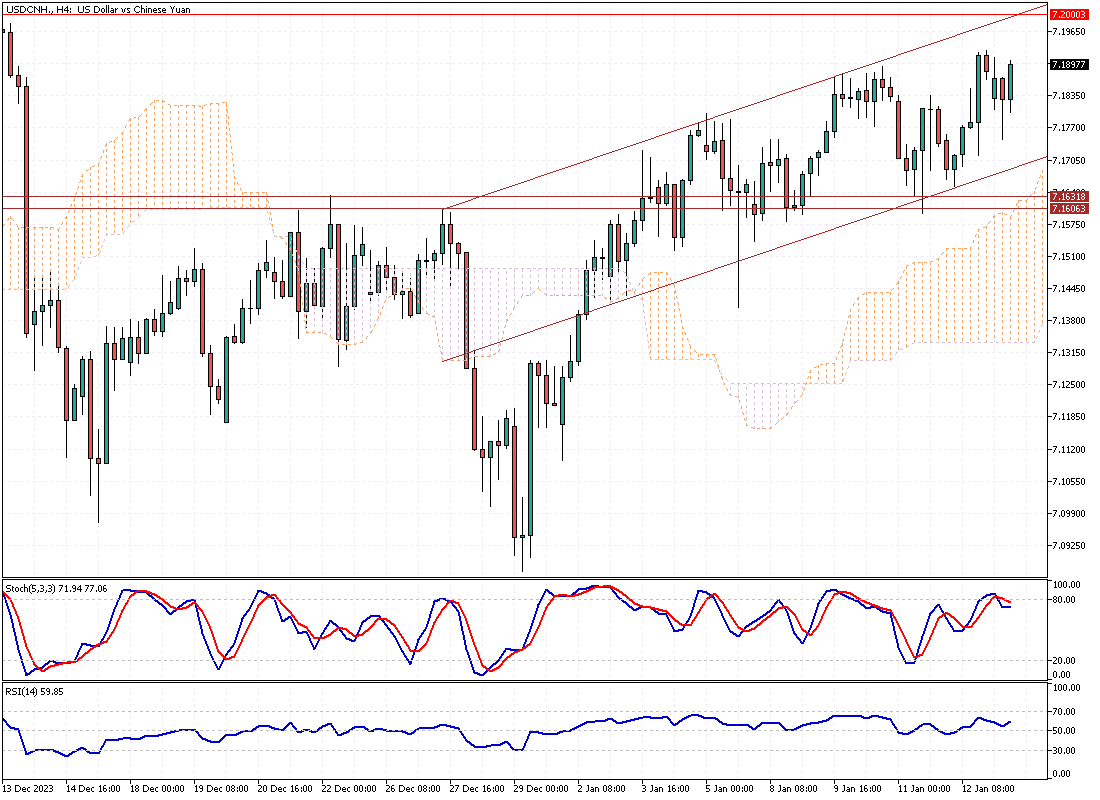

USDCNH, the offshore yuan, climbed to roughly 7.18 against the US dollar. This rise occurred when the People’s Bank of China decided not to change its medium-term loan rates. Many had anticipated a reduction to stimulate the economy. However, the central bank kept the one-year lending rate at 2.5%. This move aims to balance economic growth goals with market dynamics.

Despite this, the yuan’s value hovers near its lowest in a month. This is because many still anticipate some monetary relief. China is currently dealing with falling prices, both for consumers and producers. These rates dropped by 0.3% and 2.7% in December, respectively. Investors are keenly awaiting China’s GDP data for more clues.

Additionally, a surprising drop in US producer inflation is leading to speculation. Many believe the Federal Reserve might reduce rates soon. This expectation has given the yuan an extra boost.